Who will be providing food for Puerto Rico? What is the meaning of this? Flawed though the marketplace may be, under regulated with far too often the pretense of competition by oligarchs—a term currently confined to Russia, but applicable to the corporate few—yet nevertheless the marketplace is the best tool we have. As Frank Norris […]

Archives for September 2017

HealthSouth is the largest rehabilitation hospital in the U.S.

“We are the nation’s largest owner and operator of inpatient rehabilitation hospitals in terms of patients treated and discharged, revenues, and number of hospitals.” ++++ Eerily relevant. Stay tuned for how it is relevant. “We provide specialized rehabilitative treatment on both an inpatient and outpatient basis. We operate hospitals in 30 states and Puerto […]

Economic sanctions will hurt U.S. farmers for a generation at least

U.S. Presidents, during my 70 year lifespan, have been working overtime to endanger the U.S. agricultural economy. The summer of 2017, U.S. Secretary of Agriculture Sonny Perdue, one of the few “adults” making domestic policy in the Trump Administration, was in China praising the Peoples Republic of China for its increased purchases of meat. Now […]

Martin Luther King, Jr. On NBC’s Meet the Press (1965)

++++ On March 28, 1965, Martin Luther King, Jr. appeared on NBC’s Meet The Press to discuss his historic five-day march from Selma to Montgomery, Alabama.

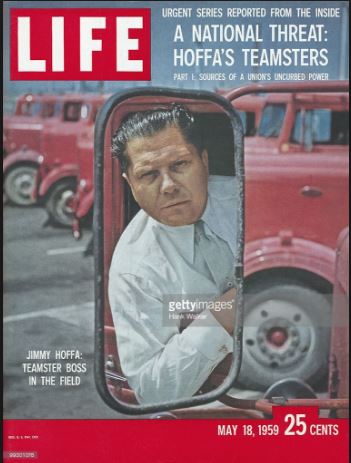

In my lifetime, the Labor Union movement in the United States has been led by three titans.

The first ( and in many ways the most significant) titan was/is the late Jimmy Hoffa. His genius in creating a universal contract that included even independent drivers has created a center of strength in the Teamsters Union. The result is that in a […]